UK: Opportunities using Cyprus

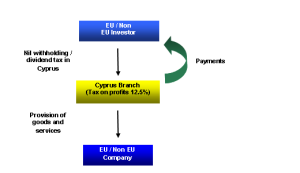

UK Company controlled and managed by a branch in Cyprus

A Company registered in the UK is not taxed in the UK if its place of effective management (branch) is in Cyprus and not in the UK.

UK – Cyprus double tax treaty contains a “tie-breaker” clause where a company is not managed and controlled in the UK and the company could be regarded as resident in both countries, then the company will be considered tax resident in the other state i.e. Cyprus.

Opportunity

UK companies registered in the UK involved in activities outside the UK can set up a Cyprus branch thus having their management and control in Cyprus and be taxed in Cyprus at the rate of 12,5%

UK COMPANY CONTROLLED AND MANAGED BY A CYPRUS BRANCH

UK Company managed and controlled by a Cyprus branch

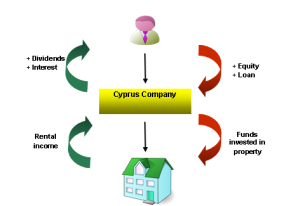

Investment in UK Property by Non-UK-Residents (Physical or Legal persons):

+ A non-UK-resident is not subject to UK tax on capital gains from investment in UK property.

+ Where UK property is acquired for commercial reasons and thus is purchased, developed and sold for a short period of time, the different tax treatment is applied.

+ Rental Income – profits derived from UK property is taxable in the UK irrespective of buyer residency status and is taxable as follows:

– A Non-resident individual owner is taxed at the rate between 20% and 45% depending on the number of profits

– A Non-resident company (i.e. Cyprus) is taxable at the rate of 20%

– A UK resident company is taxable at UK normal rates of corporation tax (both on income and gains)

Opportunity

+ Acquire UK property via Cyprus Company (non-UK resident company)

+ It is recommended that non-UK resident company sources of funds used to acquire UK property should preferably be through a loan. Loan interest expense will be an allowable deduction from rental income. However, a loan should be:

– Preferably be secured on UK property.

– Loan interest rates should be on arm’s length principle.

– There should be an adequate level of equity contribution by the non-UK resident company

+ Shares of a Cyprus company (a non-UK company) might not be subject to Inheritance tax in the UK for non-UK domiciles.

INVESTMENT IN UK PROPERTY BY NON-UK RESIDENTS (I.E. CYPRUS)

Investments in UK property by non – UK residents (Via Cyprus)

UK pension income received by Cyprus tax residents

In Cyprus, UK pension income received from Cyprus tax residents may be taxed either

+ A flat rate of 5% on the excess € 3,420, or

+ At Cyprus normal scaling rates.

The decision is taken each year, after the completion of the tax return. This is to give Cyprus tax residents the ability to change from year to year.

Opportunity

All forms of UK pension income received by Cyprus tax residents are taxable only in Cyprus at in most cases 5%. (UK – Cyprus Double Tax Treaty state that all forms of pensions arising in the UK, including UK Government pensions, shall be taxable only in Cyprus and not in the UK)

Contact us

Please contact us for a free personal consultation

Email: info@pkf-nic.com

Published: January 2016

The authors expressly disclaim all and any liability and responsibility to any person, entity or corporation who acts or fails to act as a consequence of any reliance upon the whole or any part of the contents of this document. Accordingly no person, entity or corporation should act or rely upon any matter or information as contained or implied within this publication without first obtaining advice from an appropriately qualified professional person or firm of advisors

PKF / ATCO Limited is a member firm of the PKF International Limited network of legally independent firms and does not accept any responsibility or liability for the actions or inactions on the part of any other individual member firm or firms. This publication is for information purposes only and should not be considered as professional advice.