A member of PKF International. A global family of legally independent firms.

CROSS-BORDER REORGANISATION TYPES PRESENTED IN A DIAGRAMMATIC FORMAT

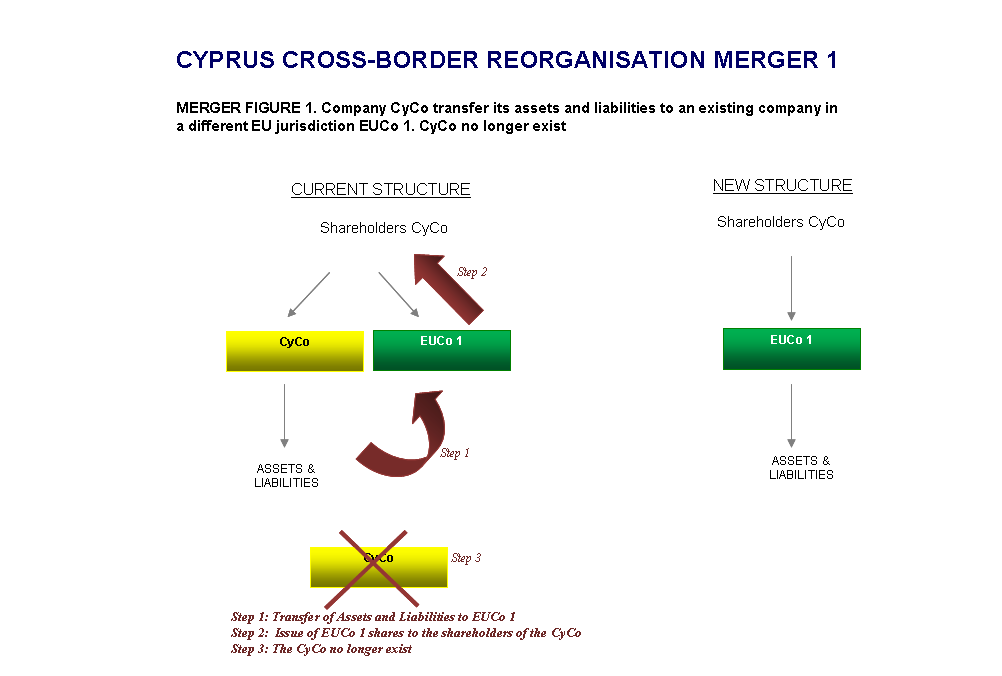

CYPRUS CROSS-BORDER MERGER STRUCTURE 1. Company Cyprus Company transfers its assets and liabilities to an existing company in a different European Union jurisdiction European Union Company 1. Cyprus Company no longer exists.

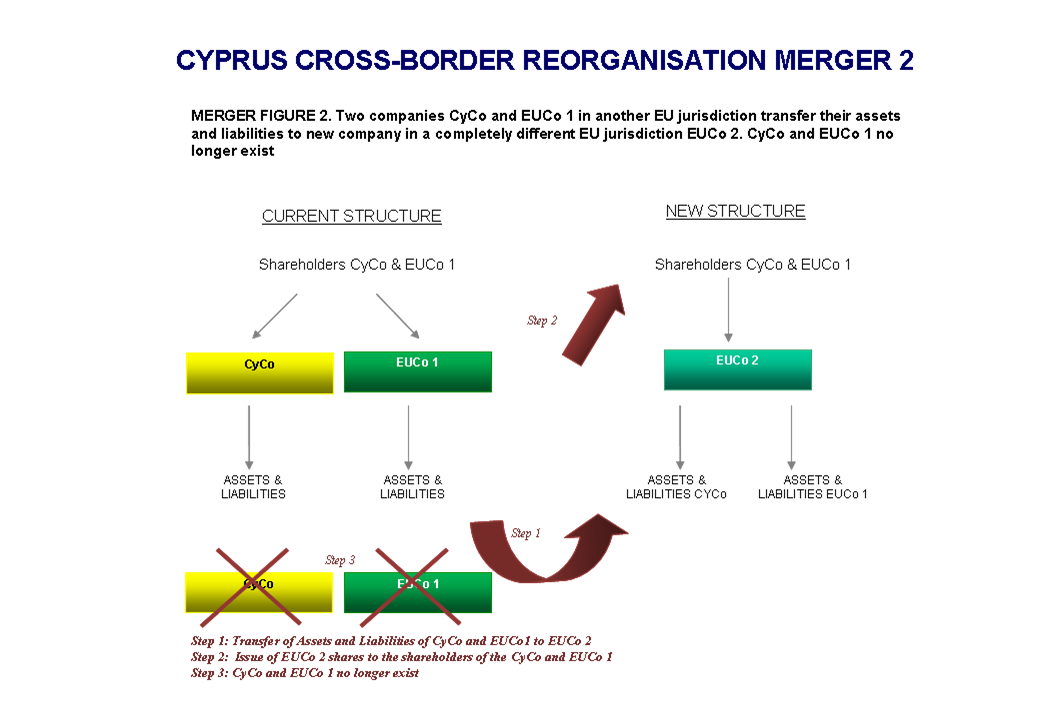

CYPRUS CROSS-BORDER MERGER STRUCTURE 2. Two companies Cyprus Company and European Union Company 1 in another European Union jurisdiction transfer their assets and liabilities to a new company in a completely different European Union jurisdiction European Union Company 2. Cyprus Company and European Union Company 1 no longer exist.

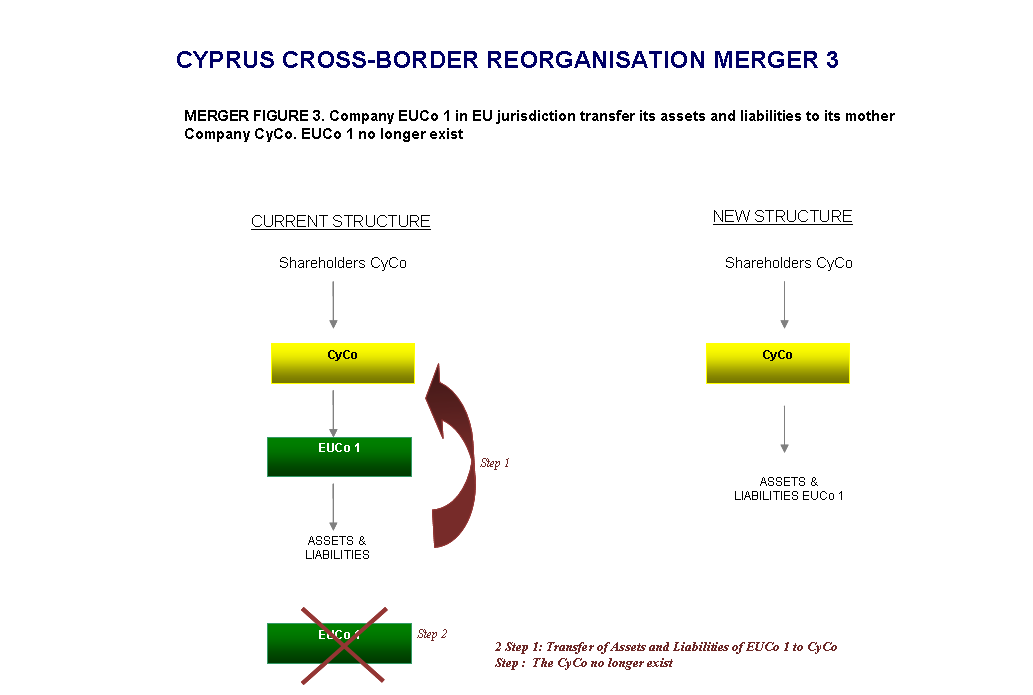

CYPRUS CROSS-BORDER MERGER STRUCTURE 3. European Company 1 in European Union jurisdiction transfers its assets and liabilities to its mother Company Cyprus Company. European Company 1 no longer exists.

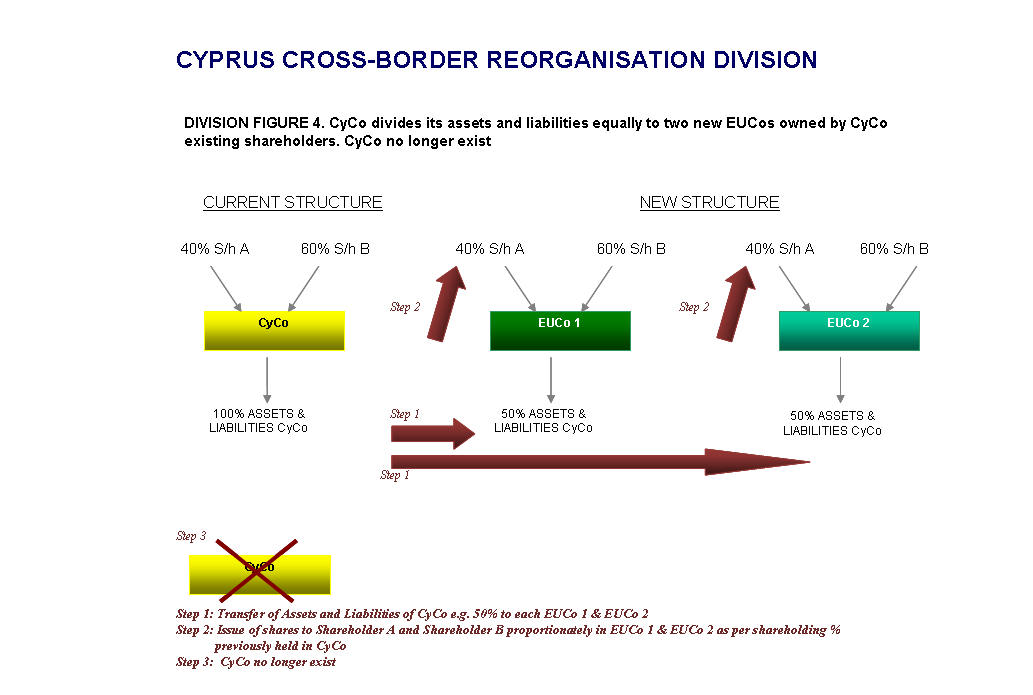

CYPRUS CROSS-BORDER DIVISION STRUCTURE 4. Cyprus Company divides its assets and liabilities equally to two new European Union Companies owned by Cyprus Company’s existing shareholders. Cyprus Company no longer exists.

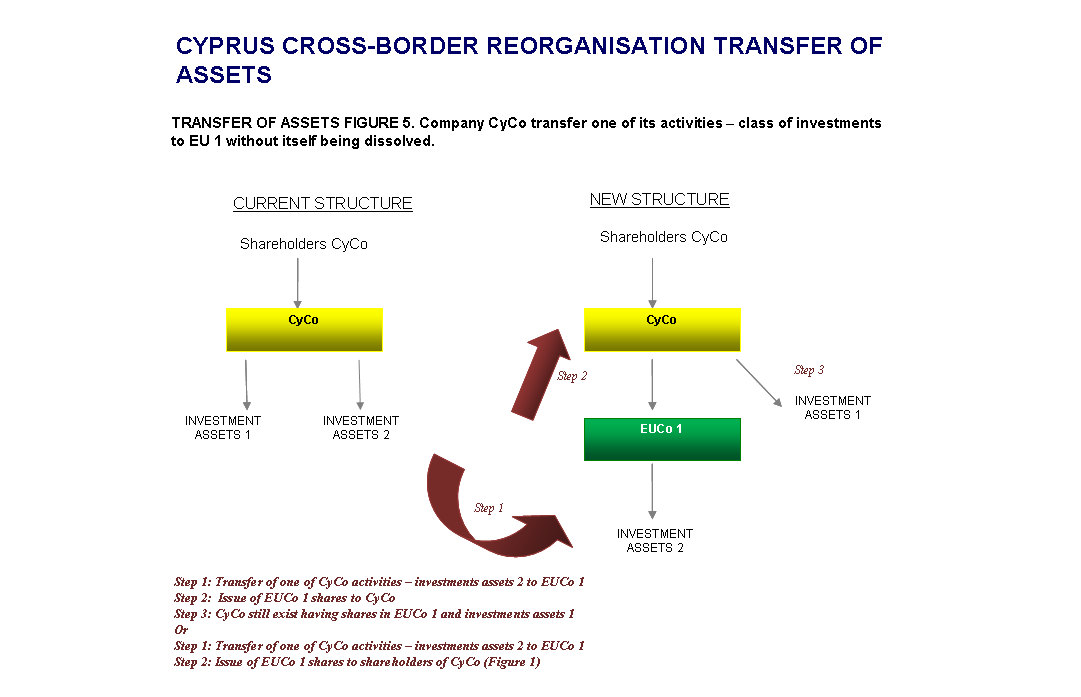

CYPRUS CROSS-BORDER TRANSFER OF ASSETS STRUCTURE 5. Company Cyprus Company transfers one of its activities – class of investments to European Union 1 without itself being dissolved.

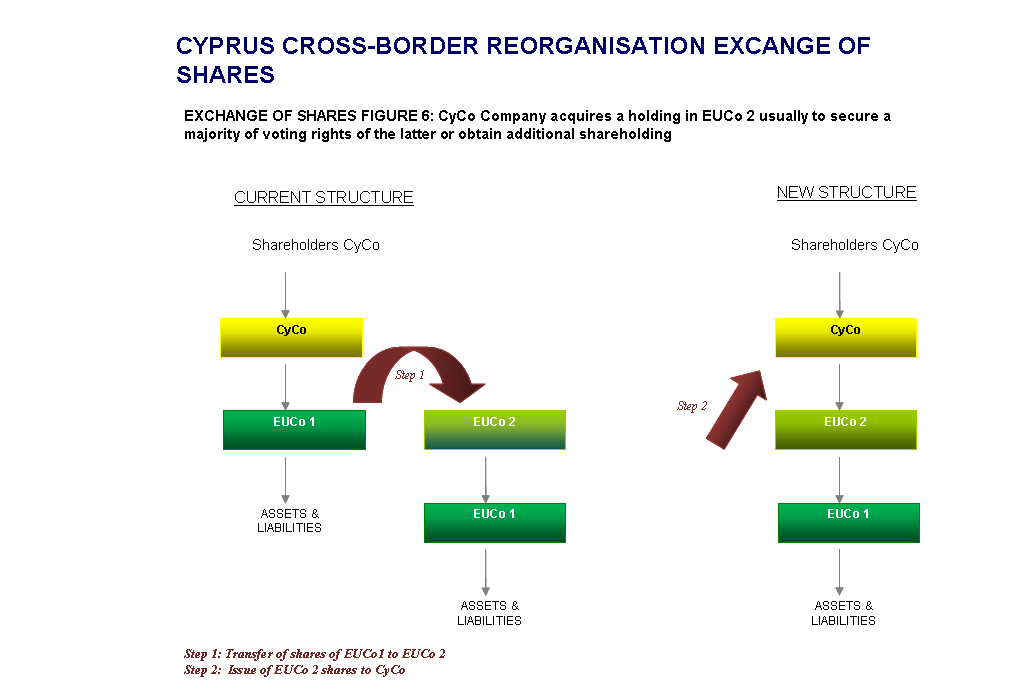

CYPRUS CROSS-BORDER EXCHANGE OF SHARES STRUCTURE 6. Cyprus Company acquires a holding in European Union Company 2 usually to secure a majority of voting rights of the latter or obtain additional shareholding.

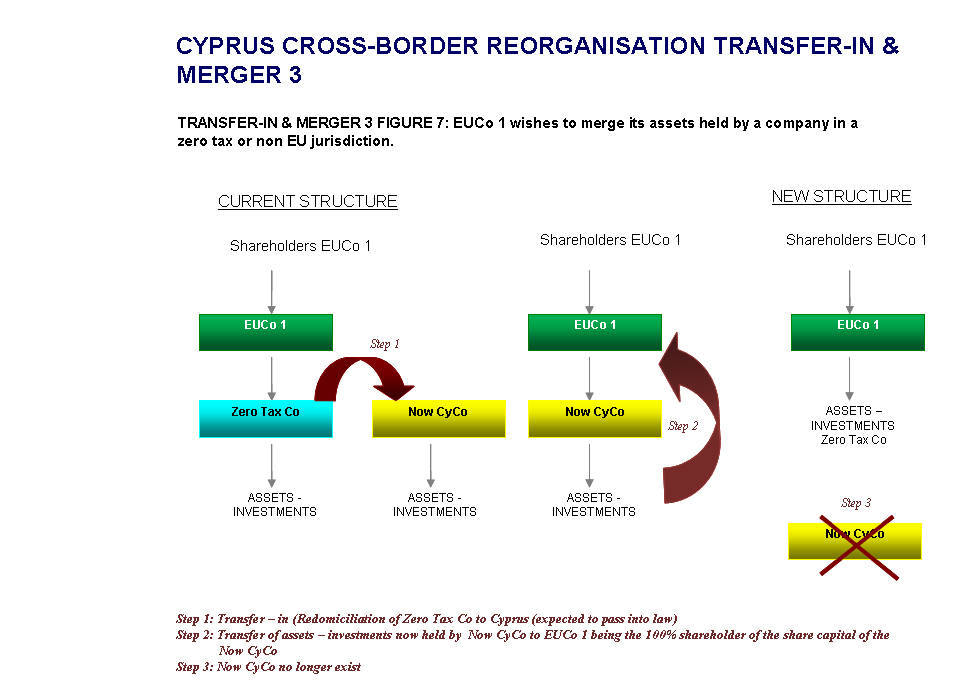

CYPRUS CROSS-BORDER TRANSFER-IN & MERGER 3 STRUCTURE 7: European Union Company 1 wishes to merge its assets held by a company in a zero tax or non-European Union jurisdiction.

Contact

For a personal consultation please contact

Email: info@pkf-nic.com

The authors expressly disclaim all and any liability and responsibility to any person, entity or corporation who acts or fails to act as a consequence of any reliance upon the whole or any part of the contents of this publication.

Accordingly no person, entity or corporation should act or rely upon any matter or information as contained or implied within this publication without first obtaining advice from an appropriately qualified professional person or firm of advisors, and ensuring that such advice specifically relates to their particular circumstances.

PKF Cyprus firms are member firms of the PKF International Limited network of legally independent firms and do not accept any responsibility or liability for the actions or inactions on the part of any other individual member firm or firms.