.

Structuring Investments in/from Ukraine through Cyprus

There have been new changes in Ukraine – Cyprus Double Tax Treaty. Specifically, Cyprus and Ukraine signed a protocol to amend the existing double tax avoidance agreement on income and capital taxes. The provisions of the signed Protocol between Cyprus and Ukraine shall enter into force on 1 January 2019.

The protocol is based on the OECD Model Tax Convention for the avoidance of double taxation of income and capital and will contribute to the further development of trade and economic ties between Cyprus and Ukraine.

Key changes in summary:

Ukraine – Cyprus Double Tax Treaty main provisions applicable up to 1 January 2019

- Withholding tax rate on dividends 5%. 5% withholding tax on dividends applies if the beneficial owner of the dividends is a company that holds at least 20% of the capital of the company paying the dividend or has invested at least € 100,000 in the acquisition of shares.

- Withholding tax rate on interest 2%

- Withholding tax rate on royalties 5%. Withholding tax rate on royalties 5% applies on the copyright of scientific work, a patent, trademark, secret formula, and 10% applies on all other cases

- Capital Gains Tax – Shares in a company owing to immovable property are disposed of without taxation in the country of the company holding the property. The taxing right rests with the country of the seller.

Ukraine – Cyprus new protocol effective as from 1 January 2019

- Withholding tax rate on dividends 5%. 5% withholding tax on dividends will apply if the beneficial owner of the dividends is a company that holds at least 20% of the capital of the company paying the dividend and has invested at least € 100,000 in the acquisition of shares.

- Withholding tax rate on interest 5%

- Withholding tax rate on royalties 5%. Withholding tax rate on royalties 5% will apply on the copyright of scientific work, a patent, trademark, secret formula, and 10% on all other cases

- Capital Gains Tax – Shares in a company owing immovable property (deriving at least 50% of their value from the immovable property) are disposed of without taxation in the country in which the immovable property is situated (subject to exemptions i.e. for entities listed on an approved stock exchange, where the immovable property is used in the company’s business of public companies, Real Estate Funds, etc.)

Other important considerations

- The “most favorable national clause” was granted for taxes on interest, dividends, royalties and capital gains. This means that if Ukraine concludes a Double Tax Treaty with another country that provides for more favorable provisions for dividends, interest, royalties and capital gains than those provided to Cyprus, the Cyprus-Ukraine Double Tax Treaty should be amended accordingly.

- Other amendments have been introduced so as to consider the OECD treaty model and various international practices like the changes of the definition of Permanent Establishment, the adoption of the beneficial ownership principle, the exchange of information in tax matters i.e. the information will be as much information as is foreseeably relevant, etc.

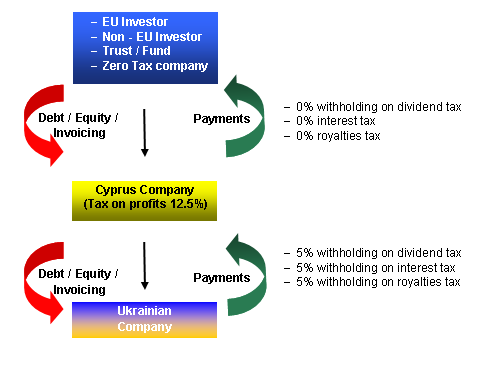

Structure – Investment in Ukraine through Cyprus (considering Cyprus – Ukraine new protocol coming into effect as of 1 January 2019)

Notes:

- Dividend interest and royalty payments from Cyprus to non-Cyprus tax residents are not subject to tax in Cyprus. Dividend interest and royalty payments from Cyprus to non-EU countries may be subject to low or 0% taxes in accordance with the double tax treaty of the Non-EU country with Cyprus. Dividend interest and royalty payments from Cyprus to EU countries are usually subject to 0% taxes in accordance with EU directives

- Beneficial owner of income. Double tax treaty provisions including the Cyprus – Ukraine tax treaty provisions will apply provided the recipient of income (dividends, interest, royalties etc) is the beneficial owner of such income. Beneficial owner of the income is where recipient company’s powers may be exercised by its directors without the interference of its shareholders, sufficient economic substance is present, income is reported in recipients bank account and financial statements, free deal with inflow of funds by recipient, recipient has the ability to make decisions on its own and having fully fledged offices and employ full time or part time employees, Income received in a form of interest should be in the form of unrelated payment received and be at arms length with adequate margin returns

Contact us

Please contact us for a free personal consultation on

The authors expressly disclaim all and any liability and responsibility to any person, entity or corporation who acts or fails to act as a consequence of any reliance upon the whole or any part of the contents of this publication.

Accordingly no person, entity or corporation should act or rely upon any matter or information as contained or implied within this publication without first obtaining advice from an appropriately qualified professional person or firm of advisors, and ensuring that such advice specifically relates to their particular circumstances.

PKF Cyprus firms are member firms of the PKF International Limited network of legally independent firms and do not accept any responsibility or liability for the actions or inactions on the part of any other individual member firm or firms.