.Structuring investments in/from South Africa through Cyprus

Τhere have been changes on the South Africa – Cyprus Double Tax Treaty. The changes are in force as they have been ratified by both countries. The amended treaty opened the way for further development and new business opportunities between the two countries.

Even after the change, Cyprus is still considered as one of the preferred routes for both South Africa inward and outward investments. The key changes of the treaty relating to the dividends tax and the exchange of information.

Old South Africa – Cyprus Double Tax Treaty main provisions

- Withholding tax rate on dividends 0%

- Withholding tax rate on interest 0%

- Withholding tax rate on royalties 0%

- Capital Gains Tax – Shares in a company owing movable or immovable property are disposed of without taxation in the country of the company holding the property

Amended South Africa – Cyprus Double Tax Treaty main provisions as ratified by both countries (retrospective effect from 1 April 2012)

- Withholding tax rate on dividends has been increased from 0% to 10% or to 5% if at least 10% in the share capital of the company distributing the dividends.

- Withholding tax rate on interest 0%

- Withholding tax rate on royalties 0%

- Capital Gains Tax – Shares in a company owing movable or immovable property are disposed of without taxation in the country of the company holding the property. The taxing right still remains with the country of the seller

- Residence -The definition of “resident in a Contracting State” is aligned with the 2010 OECD treaty model

- Exchange of information – aligned with the OECD Model. The level of information that is expected to be exchanged between the two States will be as much information as is foreseeably relevant

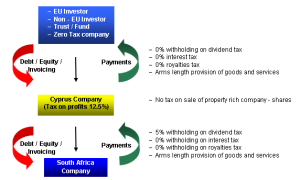

Structure – Investment in South Africa through Cyprus (considering amended South Africa – Cyprus Double Tax Treaty main provisions)

Investment in South Africa through Cyprus

Notes:

- Profit from sale of shares of property rich companies is tax-exempt in Cyprus provided property not situated in Cyprus

- Dividend interest and royalty payments from Cyprus to Non-Cyprus tax residents are not subject to tax in Cyprus. Dividend interest and royalty payments from Cyprus to Non-EU countries may be subject to low or 0% taxes in accordance with the double tax treaty of the Non-EU country with Cyprus. Dividend interest and royalty payments from Cyprus to EU countries are usually subject to 0% taxes in accordance with EU directives

- Dividend interest and royalty payments from South Africa to Cyprus are subject to low (5% on Dividends) or no (0% on interest and royalties) tax under Cyprus – South Africa double tax treaty new provisions

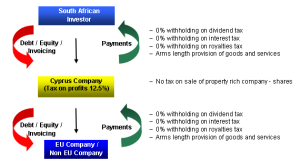

Structure – Investment from South Africa through Cyprus structure (considering amended South Africa – Cyprus Double Tax Treaty main provisions)

Investment from South Africa through Cyprus structure

Notes:

- Profit from sale of shares of property rich companies is tax-exempt in Cyprus provided property not situated in Cyprus

- Dividend, interest and royalty payments from Cyprus to South Africa are not subject to a withholding tax in Cyprus. The Cyprus – South Africa double tax treaty amendments affect only dividend payments from South Africa as Cyprus does not impose a withholding tax on outbound dividends to non-Cyprus residents

- Dividend interest and royalty payments from EU / Non-EU countries to Cyprus are not subject to tax in Cyprus subject to easily met conditions. Dividend interest and royalty payments from Non-EU countries to Cyprus may be subject to low or 0% taxes in accordance with the double tax treaty of the Non-EU country with Cyprus. Dividend interest and royalty payments from EU countries to Cyprus are usually subject to 0% taxes in accordance with EU directives

The beneficial owner of income

Double tax treaty provisions including Cyprus – South Africa double tax treaty provisions will apply provided the recipient of income (dividends, interest, royalties, etc) is the beneficial owner of such income. The beneficial owner of the income is where recipient company’s powers may be exercised by its directors without the interference of its shareholders, sufficient economic substance is present, income is reported in the recipient’s bank account and financial statements, free deal with the inflow of funds by the recipient, the recipient has the ability to make decisions on its own and having fully-fledged offices and employ full time or part-time employees, Income received in a form of interest should be in the form of unrelated payment received and be at arm’s length with adequate margin returns

Conclusion

The double tax treaty between Cyprus and South Africa still remains competitive as before. The above dividend withholding tax rates are competitive amongst South Africa’s double taxation network. The double tax treaty between Cyprus and South Africa continues to provide for a zero withholding tax on interest and royalty. In addition, Cyprus retains the exclusive right to tax any disposal of shares in a company owning movable or immovable property in South Africa.

Contact us

Please contact us for a free personal consultation on:

PKF / ATCO Limited is a member firm of the PKF International Limited network of legally independent firms and does not accept any responsibility or liability for the actions or inactions on the part of any other individual member firm or firms. This publication is for information purposes only and should not be considered as professional advice.